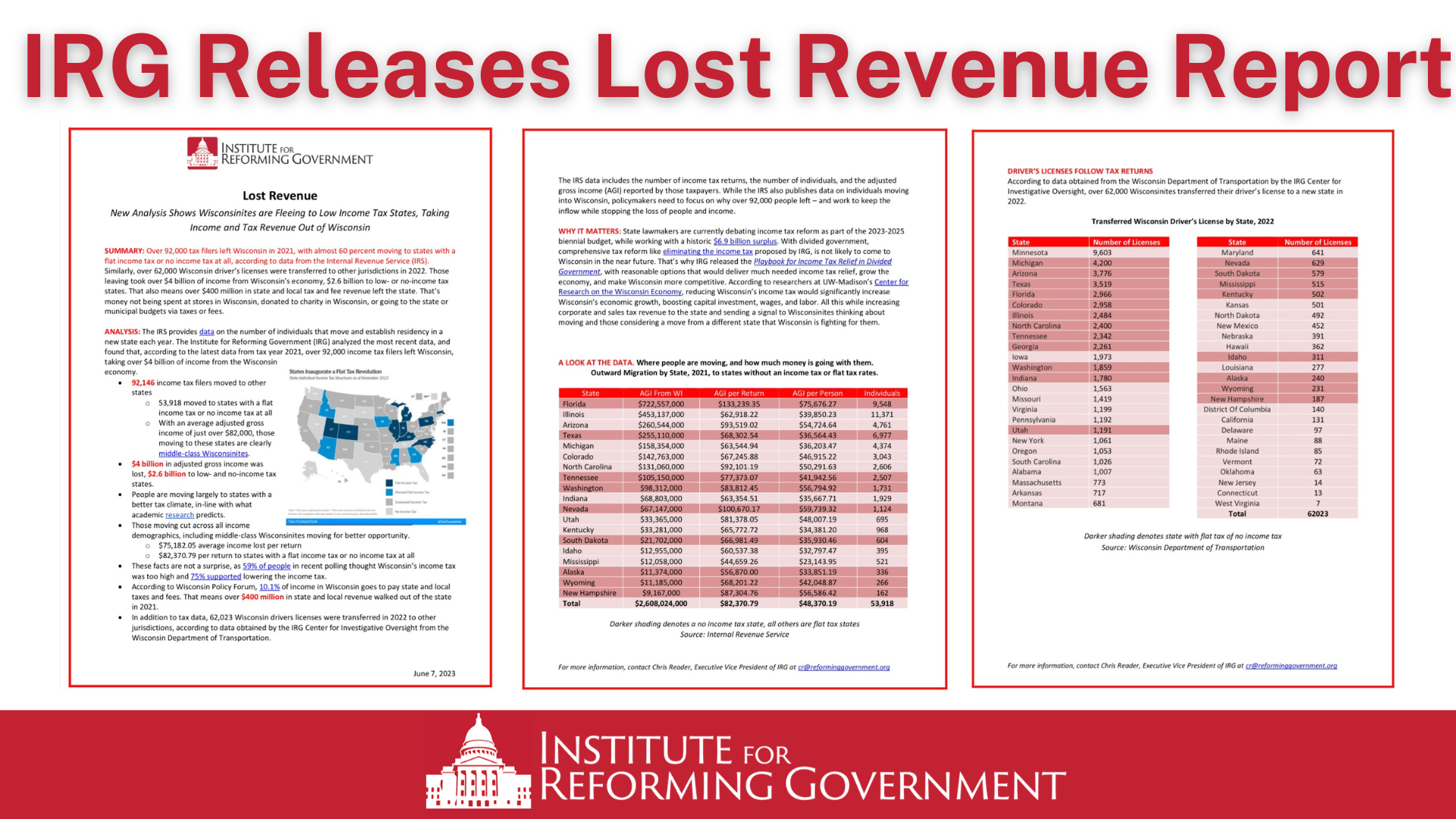

WHAT IT IS: A new report by IRG, Lost Revenue, details how over 92,000 income tax filers left Wisconsin in 2021, with almost 60% of them moving to states with either a flat income tax or no income tax at all. Using recently released data from the IRS to compile this report, IRG found that of the $4 billion of income that left Wisconsin in 2021, over $2.6 billion went to flat and no income tax states. The report also highlights data from the Wisconsin Department of Transportation showing that the majority of people who transferred their driver’s license in 2022 did so in states with a flat tax or no income tax.

Along with this money not being spent at local Wisconsin restaurants or stores – or being donated to Wisconsin charities – it also means the state and local governments lost over $400 million in tax revenue.

WHY IT MATTERS: The people leaving Wisconsin for states with a better tax climate are not just the well-off, they are middle class workers and families looking for better opportunities. The average income tax return that left Wisconsin for a flat or no income tax state in 2021 had an adjusted gross income of $82,370.79. In total, over 92,000 people left Wisconsin in 2021 and took $4 billion in income with them.

“Our high income taxes are driving Wisconsinites to leave the state. Not only is this hollowing out the middle class and harming small businesses, it’s costing our economy billions each year, including hundreds of millions of dollars of potential tax revenue. It’s time for bipartisan tax reform that will keep workers here and pull more people into the state to grow the economy.” – Chris Reader, IRG Executive Vice President

WHAT’S NEXT: In order to keep Wisconsinites from leaving the state, Wisconsin policymakers need to continue cutting taxes at every bracket to give relief to the middle class, small businesses, and job creators. IRG’s recent Playbook for Income Tax Relief in Divided Government shows lawmakers how to do this in a way that would – according to UW-Madison’s Center for Research on the Wisconsin Economy – result in over $2.5 billion in tax cuts and over $600 annual savings to middle class families.