IRG’s Take: “Americans are growing increasingly nervous and delaying major (even minor) purchases. Meanwhile investors are seeking safer havens as they play with our 401Ks, sending the economy further towards recession. At a minimum, talk of a “soft-landing” is more fictitious than ever, and there is little reason to expect inflationary pressures to abate in the near term, if at all.”

Additional Context from IRG:

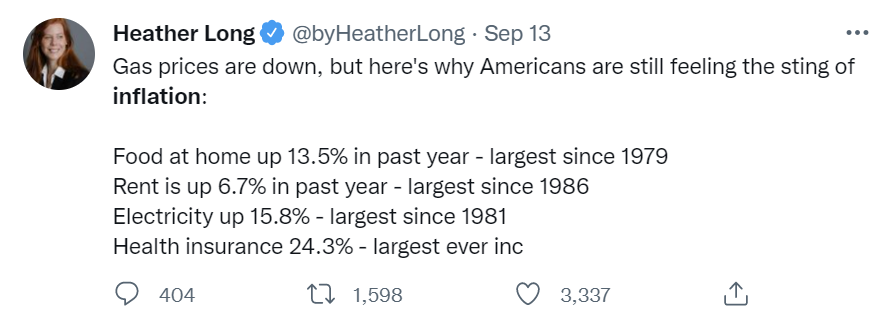

What happened? CPI, the recognized standard for assessing inflation and general economic trends, rose 8.3% for August. While this is down slightly from the last two months, it alarmed the markets enough to cause a nearly 1,300 drop in the Dow – the worst day since June 2020.

Why it matters? Investor confidence is low as markets anticipated a lower CPI number. The 8.3% figure is surprisingly high, as energy prices had moderated slightly from midsummer highs. If energy and food prices are removed, core prices rose at double the expected rate, largely due to sky-high housing costs. Even with wages continuing their climb amidst a persistent labor shortage, it isn’t enough to keep up with inflation. Instead, each appears to be giving the other momentum – an inflationary death spiral.

What’s next? The Federal Reserve is likely to raise interest rates by an additional 0.75% later this month. Thus, consumers are faced with rising interest rates, stagnating wages (compared to inflation), a broken supply chain, tight labor market, unrealistic “green” energy fantasies, and other self- inflicted macroeconomic policy. This situation has no historical precedents. But the Federal Reserve still has really only one very blunt instrument – inexact manipulation of interest rates.