A PDF of this policy paper can be found here

Governor Scott Walker and the reform-minded legislature turned Wisconsin around with bold reforms including the well known 2011 Wisconsin Act 10 (Act 10). After Governor Walker took office in 2011, his first Executive Order noted that the “State of Wisconsin is in an economic emergency caused by years of mismanagement”[1] and called a January Special Session “to help create a new, healthy, and vibrant climate for private sector job creation.”[1] During Governor Walker’s first State of the State address on February 1st, 2011, he further made clear that Wisconsin was facing “an economic and fiscal crisis in this state that demands our immediate attention.”[2] In his 2011 State of the State address, Governor Walker would say of his Budget Repair Bill, which would eventually become 2011 Wisconsin Act 10,

“…I will introduce a budget repair bill focusing on the most immediate fiscal challenges our state must address to avoid massive layoffs or reductions in critical services… This is the right moment in time, our moment in time, to refocus government to better serve the taxpayers of this state. To do this, we must provide flexibility to our leaders at all levels…”[2]

During the January 2011 Special Session, the Committee on Senate Organization introduced Senate Bill (SB) 11[3] and the Committee on Assembly Organization introduced Assembly Bill (AB) 11,[4] at the request of Governor Walker. This legislation would eventually be known as Act 10.

In February of 2011, national attention would become focused on Wisconsin as protests grew and Senate Democrats fled to Illinois in order to delay a vote on the legislation.[5] It is during this time that Governor Walker further urged support for this legislation during his first fireside chat, while cautioning,

“…The legislation I’ve put forward is about one thing. It’s about balancing our budget now — and in the future. Wisconsin faces a 137 million dollar deficit for the remainder of this fiscal year and a 3.6 billion dollar deficit for the upcoming budget… Failure to act on this budget repair bill means (at least) [1500] state employees will be laid off before the end of June…”[6]

Nine years ago, the legislation became 2011 Wisconsin Act 10 after the report was approved by Governor Walker on March 11th and it was eventually upheld by the Wisconsin Supreme Court in 2014.[7] Following the Supreme Court’s ruling, Governor Walker “called the ruling a victory” and stated “Act 10 has saved Wisconsin taxpayers more than $3 billion.”[8] Since Wisconsin passed 2011 Wisconsin Act 10, other states have considered similar legislation and on the 9th anniversary of this legislation, it is important to revisit the details of Wisconsin’s legislation and the impact that can be seen since this legislation passed.

Health Insurance Contributions

In Governor Walker’s 2011 State of the State Address, he explained that,

“…the difficult reality is that healthcare costs and pension costs have risen dramatically and that has created a benefit system that is simply unsustainable. Government benefits have grown while so many others in the private sector have seen their benefits adjusted in order to protect jobs…”2

As noted by the Wisconsin Legislative Council Act Memo, Act 10 contained changes to health insurance premiums for both state employees and municipal employees.4 For example, for state employees, Act 10 “requires that the employer generally pay an amount not more than 88% of the average premium cost of plans offered in the tier with the lowest employee premium cost, except as otherwise provided in a collective bargaining agreement…”4 For municipal employees, “Act 10 provides that, beginning on January 1, 2012, except as otherwise provided in a collective bargaining agreement, an employer may not offer a health care coverage plan to its employees under this provision if the employer pays more than 88% of the average premium cost of plans offered in any tier with the lowest employee premium cost.”4

During the 2011 State of the State Address, Governor Walker also noted that by asking state employees to pay a “premium payment of 12%” for health care coverage that “is about half of the national average…”2 In 2011, PolitiFact Wisconsin evaluated Governor Walker’s claims relating to health care premiums and received a “true” rating.[9] In its analysis, PolitiFact noted,

“…Walker’s point is that state workers need to be more in line with their private counterparts. Walker’s numbers for state workers and the national context are right on target. And his math holds up even when the comparison is narrowed to just public employees.”9

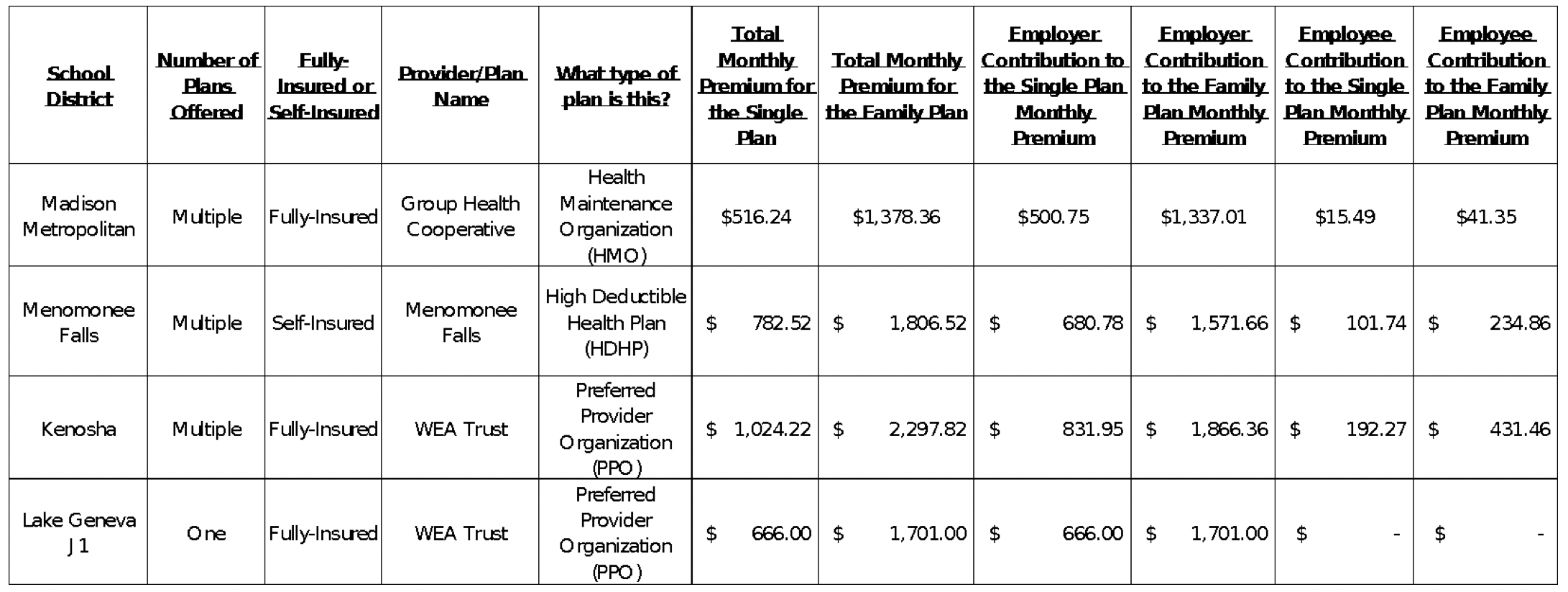

In the context of Act 10, school district health care plans are often discussed. Today, there is information that is readily accessible on school district employee health care plans for 2017-18 including the total monthly premiums for the single plan or family plan, employer contributions, employee contributions, clarifying information, and potentially additional information provided by a school district.[10] This information is the result of a 2015-17 Biennial Budget provision, which required school districts to provide information on their health care plans to the Department of Administration (DOA) and DOA then submits an annual report to the Joint Committee on Finance on:

“(a) employee health care plan design; (b) premium contributions; (c) self-insurance contributions; and (d) deductibles, copayments, coinsurance, and other methods by which employees contribute to health care costs.”[11]

Examples of information available within the “School District Health Insurance Reporting Data 2017-18” have been included below.10 For a full picture of this information, it is important to visit DOA’s website “School District Employee Healthcare 2017-18.”

Retirement Contributions

The Wisconsin Retirement System (WRS) was brought into national conversations during discussions on 2011 Wisconsin Act 10 and Wisconsin’s pension system is something that should continue to receive national attention. For background, the Department of Employee Trust Funds (ETF) administers WRS, which “…collects and invests employee and employer contributions, and pays retirement, disability, and death benefits to former employees, and their beneficiaries, of the state and participating local governments in Wisconsin.”[12] As noted within ETF’s Comprehensive Annual Financial Report,

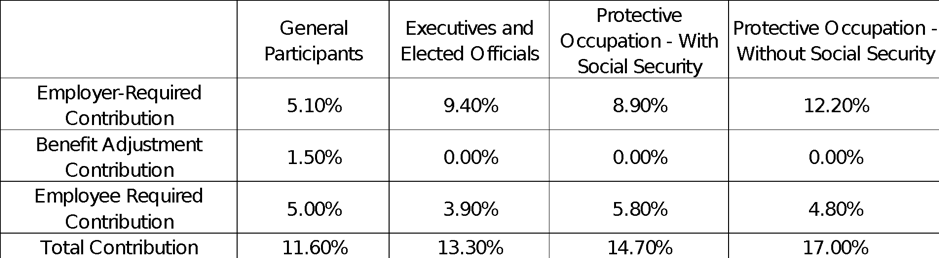

“Prior to approximately July 1, 2011, most employee contributions were paid by the employer on behalf of the employee. 2011 Act 10 restricted the employer from paying the employee required contribution, unless provided for by an existing collective bargaining agreement.”[12]

In fact, before Act 10, WRS contributions looked like this:[13]

*Wisconsin Legislative Fiscal Bureau. “State and Local Government Employment Relations Law. Informational Paper 94. January 2019.”

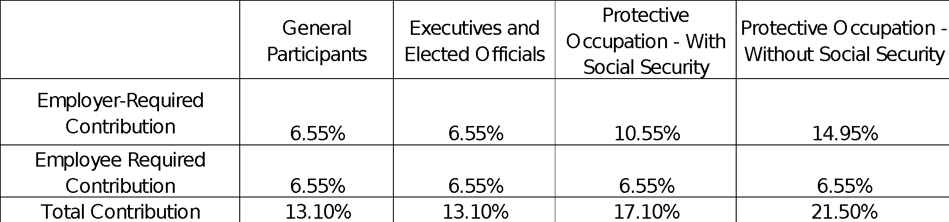

In 2019, after Act 10, WRS contributions look like this:

*Wisconsin Legislative Fiscal Bureau. “State and Local Government Employment Relations Law. Informational Paper 94. January 2019.” General Participants and Executives and Elected Official categories were combined on January 1, 2016 “for rate-setting purposes.”

In 2013, PolitiFact Wisconsin explained more about Wisconsin’s pension system and referred back to changes contained under Act 10 as it summarized a claim made by Governor Walker. Its analysis focused on Governor Walker’s claims on the differences between Wisconsin and Illinois’ pension system that were made at the end of 2012. The 2013 article summarized Governor Walker’s comments as, “’They have a pension system that’s not even halfway funded,’ Walker said of the Land of Lincoln. ‘Now, in contrast, in our state, our pension system is the only one in the country (that’s) 100 percent funded.’”[14]

At the beginning of 2013, this claim received a “true” rating and during an analysis of this claim, PolitiFact Wisconsin included references back to the changes made during Act 10,

“In 2011, much attention centered on the mandate by Walker and the Republican-controlled Legislature that most public employees pay a larger share of their pension costs… The health of the state-run Wisconsin Retirement System — which serves some 166,000 retirees and 260,000 active workers, including teachers, state and municipal employees — has received less attention.”14

In November of 2019, ETF highlighted[15] a PEW Charitable Trust article that notes, “…Wisconsin and Tennessee are two of the best-funded plans in the country…”[16] Wisconsin’s pension fund remains important to recognize given its importance to not only the “more than 632,802 current and former state and local government employees and their families rely on the WRS for some of their retirement security,” as noted by ETF, but also due to the system’s status as one of the “best-funded plans in the country” and sheer size compared to other pension funds.[17] As noted by ETF,

“With approximately $108.8 billion in assets, the WRS is the 8th largest U.S. public pension fund and the 25th largest public or private pension fund in the world. There are 632,802 individuals who participate in the WRS.”[17]

Other states can continue to look to Wisconsin as an example for its pension plan because, as ETF highlights,

- “While the average funding level for U.S. public pension plans is 72.1% and generally improving, the WRS is nearly 100% funded.”[17]

- “State and local governments spend 2.2% of their budgets on the WRS, compared to the national average of 4.5%*. No general taxes are required to support the WRS.”[17]

Conclusion

During Governor Walker’s 2011 Budget Address, he discussed the need for Act 10, when he said,

“…We introduced a budget repair bill that is the first step toward addressing the long-term challenges facing our state — while laying the foundation for economic growth. The biennial budget I introduce today is built on the savings supplied by our budget repair bill…Our state cannot grow if our people are weighed down paying for a larger and larger government. A government that pays its workers unsustainable benefits that are out of line with the private sector. We need a leaner and cleaner state government…”[18]

When Governor Walker was elected into office, he had the goal “to help create a new, healthy, and vibrant climate for private sector job creation,”[1] but he also needed to face “an economic and fiscal crisis in this state that demands our immediate attention.”[2]

Every year, the Wisconsin Legislative Fiscal Bureau publishes its “revenue estimates” for Wisconsin’s “general fund revenue and expenditure projections for the Legislature prior to commencement of legislative deliberations on the state’s budget.” In 2011, these “revenue estimates” noted appropriation shortfalls and that “…[o]ur analysis indicates a general fund gross balance of $121.4 million and a net balance of $56.4 million…”[19] Today, in 2020, these “revenue estimates” from the Wisconsin Legislative Fiscal Bureau noted that, “we project the closing, net general fund balance at the end of this biennium (June 30, 2021) to be $620.2 million.”[20]

In regards to Act 10, it has been well reported that Governor Walker has talked about the positive impacts of this legislation from stories he’s heard across various school districts to the fiscal impact of this legislation. Wisconsin’s policy changes, including those made within Act 10, continue to be something that other states should review when analyzing how to address “an economic and fiscal crisis.”[2]

Endnotes:

[1] https://docs.legis.wisconsin.gov/code/executive_orders/2011_scott_walker/2011-1.pdf

[2] Wisconsin State Journal. “Read Gov. Walker’s State of the State address as prepared for delivery.” February 1, 2011.

[3] https://docs.legis.wisconsin.gov/2011/proposals/jr1/sb11

[4] https://docs.legis.wisconsin.gov/2011/proposals/jr1/ab11

[5] Milwaukee Journal Sentinel. “Democrats flee state to avoid vote on budget bill.” February 17, 2011.

[6] Wisconsin State Journal. “Text of Gov. Walker’s ‘fireside chat’.” February 22, 2011.

[7] Wisconsin State Supreme Court. 2014 WI 99. Opinion filed on July 31, 2014.

[8] Wisconsin State Journal. “In 5-2 ruling, Supreme Court issues final word on Act 10.” July 31, 2014.

[9] PolitiFact Wisconsin. “Wisconsin Gov. Scott Walker says state employees could pay twice as much for health care premiums and still be paying half the national average.” February 8, 2011.

[10] DOA. “School District Employee Healthcare 2017-18.”

[11] Wisconsin Legislative Fiscal Bureau. “Comparative Summary of Provisions 2017 Act 59: 2017-19 Wisconsin State Budget.” November 2017.

[12] ETF. “2011 Comprehensive Annual Financial Report.”

[13] Wisconsin Legislative Fiscal Bureau. “State and Local Government Employment Relations Law: (Under 2011 Acts 10 and 32).” Informational Paper 94. January 2019.

[14] PolitiFact Wisconsin. “Walker says Wisconsin’s pension system is the only one in the country that’s fully funded.” January 6, 2013.

[15] ETF. “WRS is Among Best-Funded Public Pension Plans.”

[16] PEW Charitable Trusts. “Cost-Sharing Features Can Help State Pensions Manage Economic Uncertainty.” November 5, 2019.

[17] ETF. “Our Wisconsin Retirement System: Strong for Wisconsin.” 2018.

[18] Wisconsin State Journal. “Transcript: Gov. Scott Walker’s budget address as prepared for delivery.” March 2, 2011.

[19] Wisconsin Legislative Fiscal Bureau. “Revenue Estimates.” January 31, 2011.

[20] Wisconsin Legislative Fiscal Bureau. “Revenue Estimates.” January 23, 2020.